Award-winning PDF software

When to file 5305-SIMPLE Form: What You Should Know

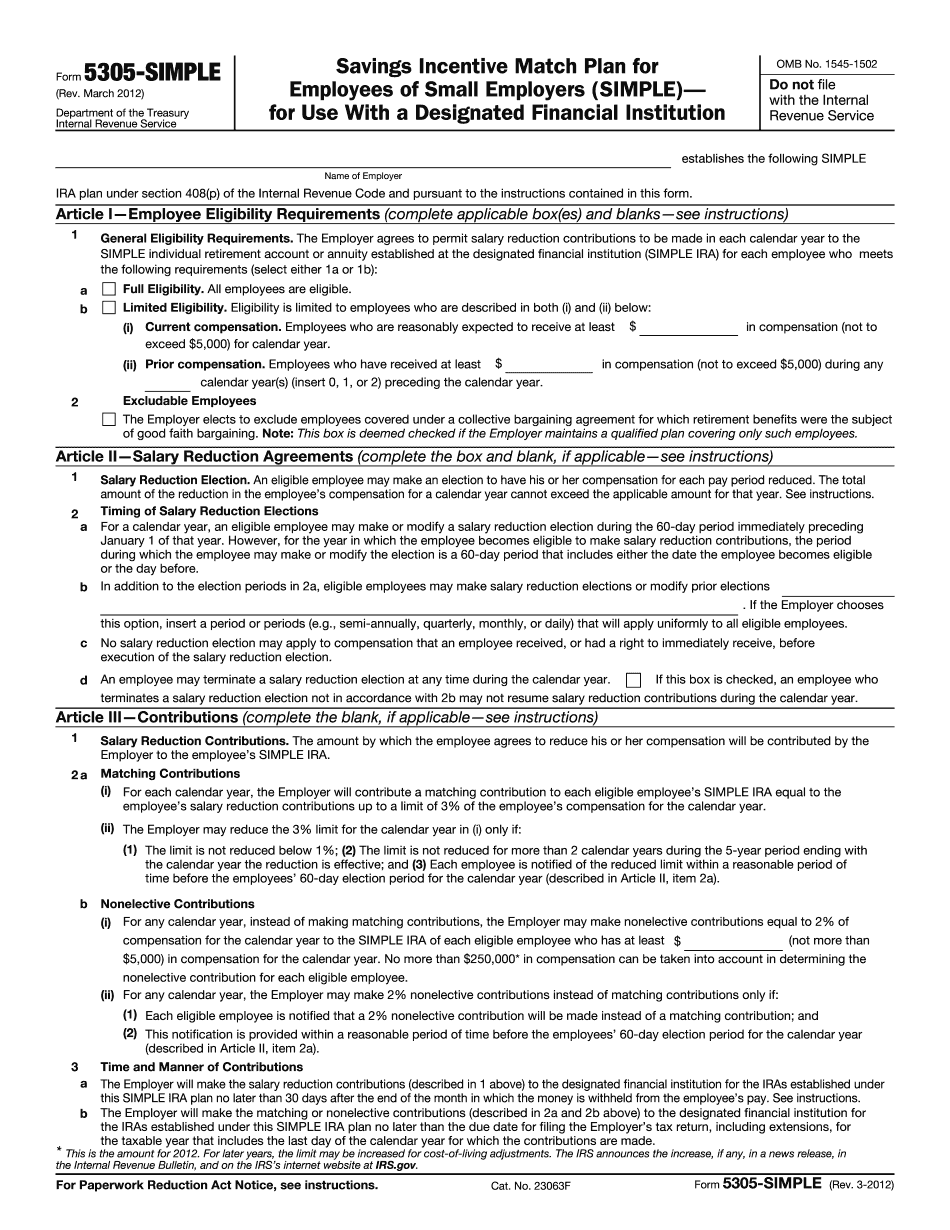

How to Open a SIMPLE IRA Plan for Your Small Business Here are your options. To open a SIMPLE IRA on behalf of an individual, complete Form 5304-SIMPLE. You can also open a SIMPLE IRA on behalf of a company group using How to Start a SIMPLE IRA for Your Business: DFI What you should know about: SIMPLE IRA Plans In this example, John (owner of the company) contributed 50,000 and Alice (owner of the company) contributed 10,000. They are both eligible for the “SIMPLE IRA” option. 6-8/18/2018 You can set up a SIMPLE IRA Plan for your business, but it is also possible to do so on your own. To open a new SIMPLE IRA (or to make it part of an existing SIMPLE IRA), follow How to Open a SIMPLE IRA for Your Small Business: DFI When you complete the form, enter the following information in the appropriate areas: First, enter the amount you want the individual or group to contribute to the SIMPLE IRA plan (as described in your plan document). You also need to determine how much money you have in the plan, and include it in the contribution amount, then add the required contributions shown in line 4 for your plan. Line 1 and 2 show either the employee's or business' salary reduction amount, whichever is larger. This amount will apply uniformly to each eligible employee and should be entered in accordance with your plan's procedures. Line 3 and 4 are for the business employee's contribution amount. You can also enter an employee contribution amount that reflects the employee's share in the business's profits, provided there is no plan provision that allows the business to contribute more to the plan than is paid by the business. Line 5 shows the amount of the business's annual nondeductible contribution (if any), if any. For more information call the financial planning staff of your financial planning program (see Financial Planning Information for Small Businesses for details). You can provide additional instructions to the plan administrator as well as make corrections. How to Start a SIMPLE IRA for Your Business: DFI You can create the SIMPLE IRA for each employee or group of employees based on your organization's requirements. Note that the SIMPLE IRA is separate from the Employer Savings Plan and must be administered independently.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5305-SIMPLE, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5305-SIMPLE online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5305-SIMPLE by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5305-SIMPLE from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.