Award-winning PDF software

Form 5305-SIMPLE Renton Washington: What You Should Know

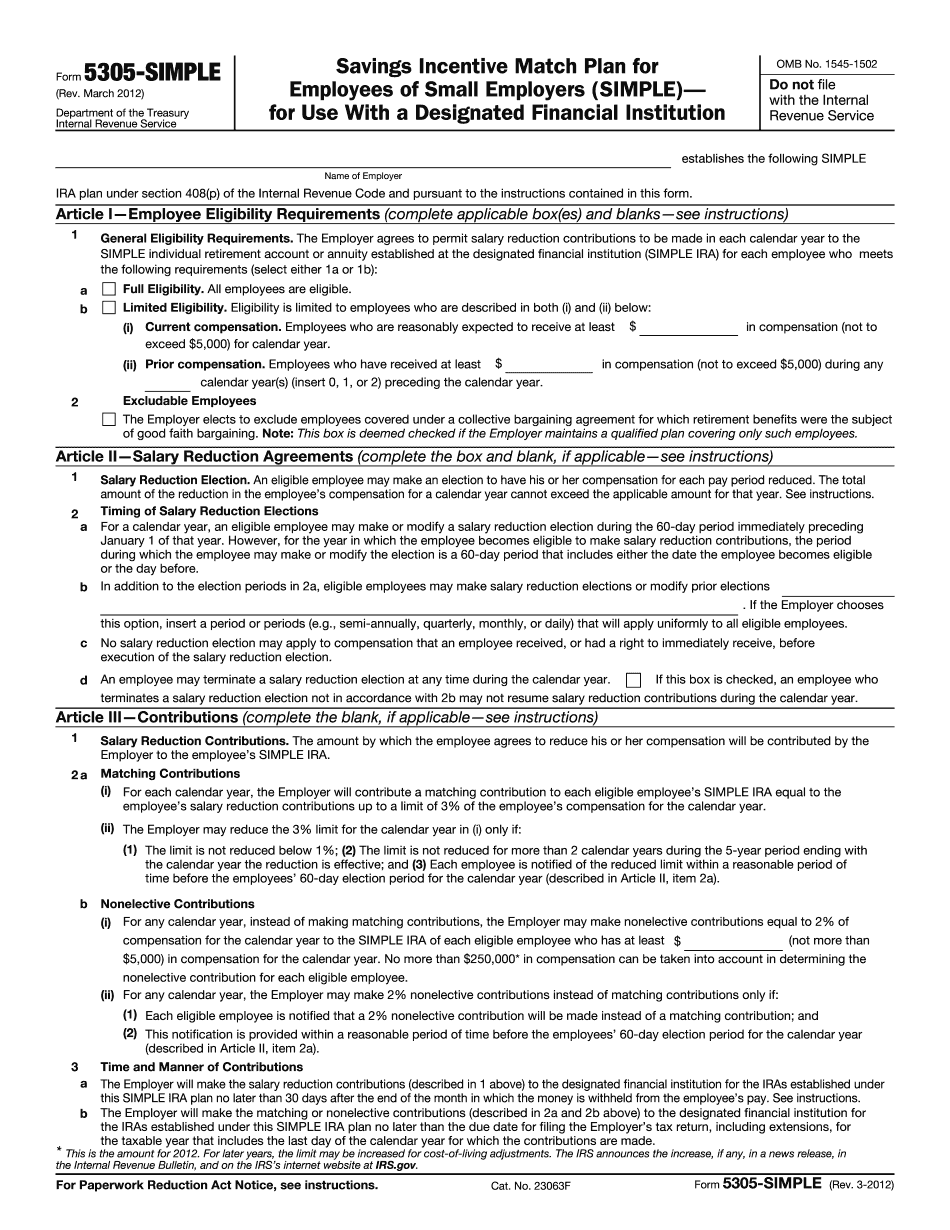

May 13, 2025 — The IRS has proposed that employers offer employees a SIMPLE IRA with a savings account and additional contributions to pay for health-related contributions and expenses, like co-payments. See the Notice to Employers in IRM 5305-SIMPLE. AFFILIATION PROGRAM (AP), FEDERAL REGULATIONS SUBSECTION (A) — IRS For more details on AP; the IRS has developed and is promoting a Federal tax program designed to benefit all taxpayers to the extent a taxpayer's eligible salary, includible income, and other resources permit. AP includes a variety of provisions for eligible employees who are eligible for Federal tax-exempt education expenses. (A) In general The Program is designed to allow certain specified educational expenses to be deducted from a taxpayer's Federal taxable income. (1) Education expenses are determined by applying one or more of the following tests and other procedures: (i) the student is a Federal employee; (ii) the expenses are qualified (or “qualified”) educational expenses; (iii) a nonemployee, nonstudent beneficiary has a direct, personal interest in the education expenses, or the student is in the position of a direct beneficiary of a qualified employer plan and that qualified employer plan is administered by a Federal agency; or (iv) the expenses have a direct and predictable effect on the conduct of the education and benefit the taxpayer in a manner closely analogous to section 107 of the Internal Revenue Code, and (vi) the expenses are allowable by reason of section 107(a). (2) Excluded amounts The IRS provides that amounts for which the AP exclusion would be allowed or denied under these rules, as adjusted, cannot be included in a taxpayer's Federal gross income for the purpose of determining eligibility for any credit or deduction (see Regulations section 1.6051-3). The specific rules are set forth separately in §§1.6051-1(b)(4) and 1.6051-1(c). (B) Eligibility criteria. To be eligible for the Program, the following requirements must be met: (1) The employee has a gross income of at least the applicable level, and (2) The employee is an eligible employee for the year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5305-SIMPLE Renton Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5305-SIMPLE Renton Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5305-SIMPLE Renton Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5305-SIMPLE Renton Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.