Award-winning PDF software

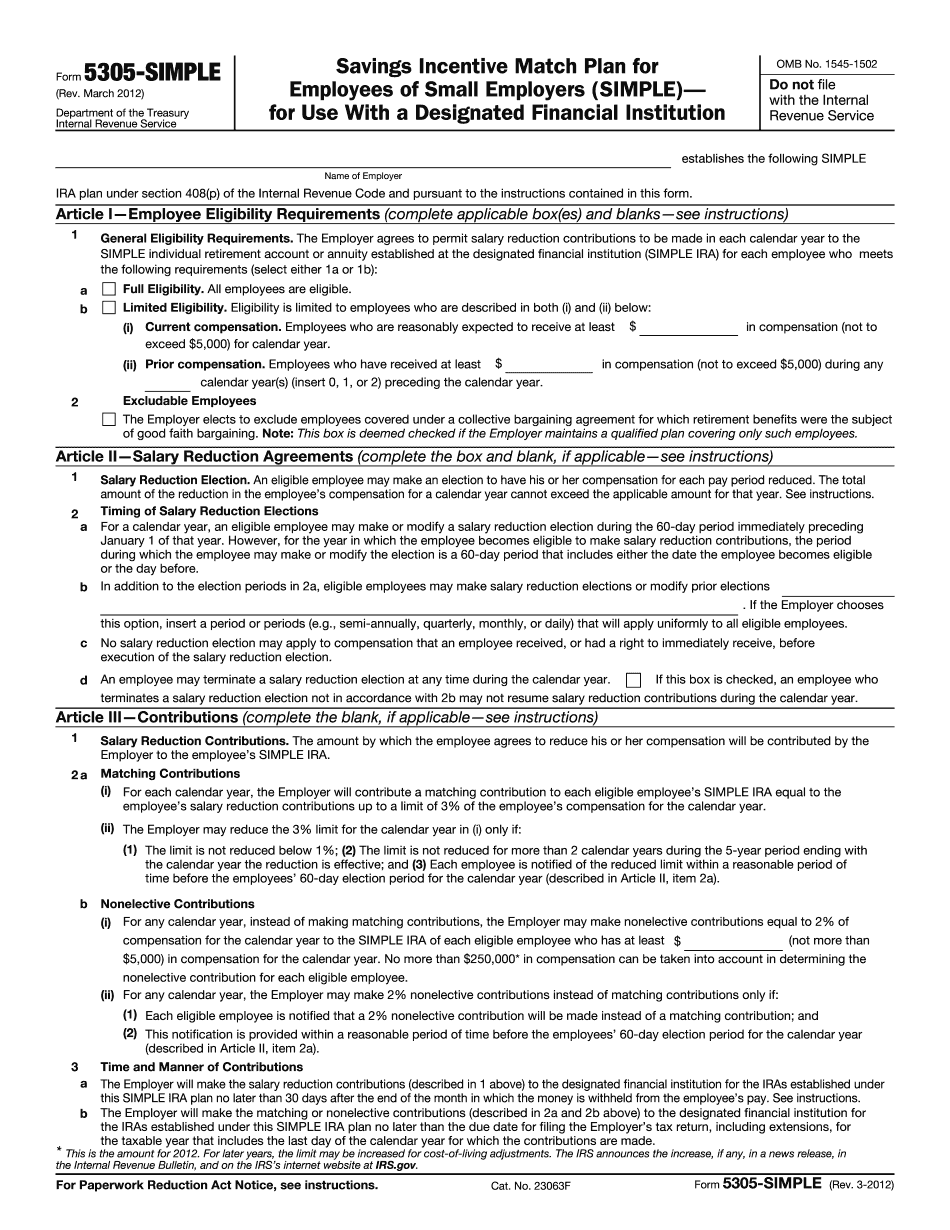

Manchester New Hampshire online Form 5305-SIMPLE: What You Should Know

All the state funded employees except those working as legislative assistants receive a 1.8% cost of living raise each year for the next five years beginning at the beginning of 2018. The minimum salary paid shall be 43,946. When a federal or state employee retires their federal pension will be reduced to the rate of pay of the state employee. When a state employee retires with 10 or more years of service, all pension will be converted into a 401(k) at the discretion of the retiring employee. If the employee has more than 10 years of state service, the state pay rate will be calculated in a manner similar to a GS-04, GS-05, GS-09 or GS-13 employee. The state pays 50 percent of the cost of pensions for federal and state employees to be provided by the retirement plan of the retired employee and 40 percent is paid by the retiring employee. It should be noted that these pay increases apply to both federal and state employees. The state must provide the employee a minimum of four months' notice if the employee wishes to increase the salary. If the state employee wishes to retire at the time the increase in pay would occur, he or she must consult with a human resource professional to decide what action to take regarding the state employee's retirement benefits. If the employee is employed by the State of New Hampshire and the employee's retirement benefits are provided through a retirement plan administered by the state, the employee can elect to be paid in the form of a regular annuity. If the pension benefits are provided by a retirement plan administered directly by another person or entity, the employee should contact that person or entity to arrange the appropriate retirement plan. If a retirement plan is set up for state employees it must be in an agency owned plan, administered by the state pension board, and must contain all the features of plan that must be in the agency owned plan. State employees must be able to withdraw from the retirement plan if they will not perform at the highest of their skill to their satisfaction. Governor's Executive Pay Schedule, Salary Table This table, which may be used by state officials for calculating their wages to reflect their current job and job title, lists and details the maximum pay rates based on salary level and education. An increase in salary must be approved by the Board of Directors for approval of salary increases.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Manchester New Hampshire online Form 5305-SIMPLE, keep away from glitches and furnish it inside a timely method:

How to complete a Manchester New Hampshire online Form 5305-SIMPLE?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Manchester New Hampshire online Form 5305-SIMPLE aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Manchester New Hampshire online Form 5305-SIMPLE from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.