Award-winning PDF software

Phoenix Arizona online Form 5305-SIMPLE: What You Should Know

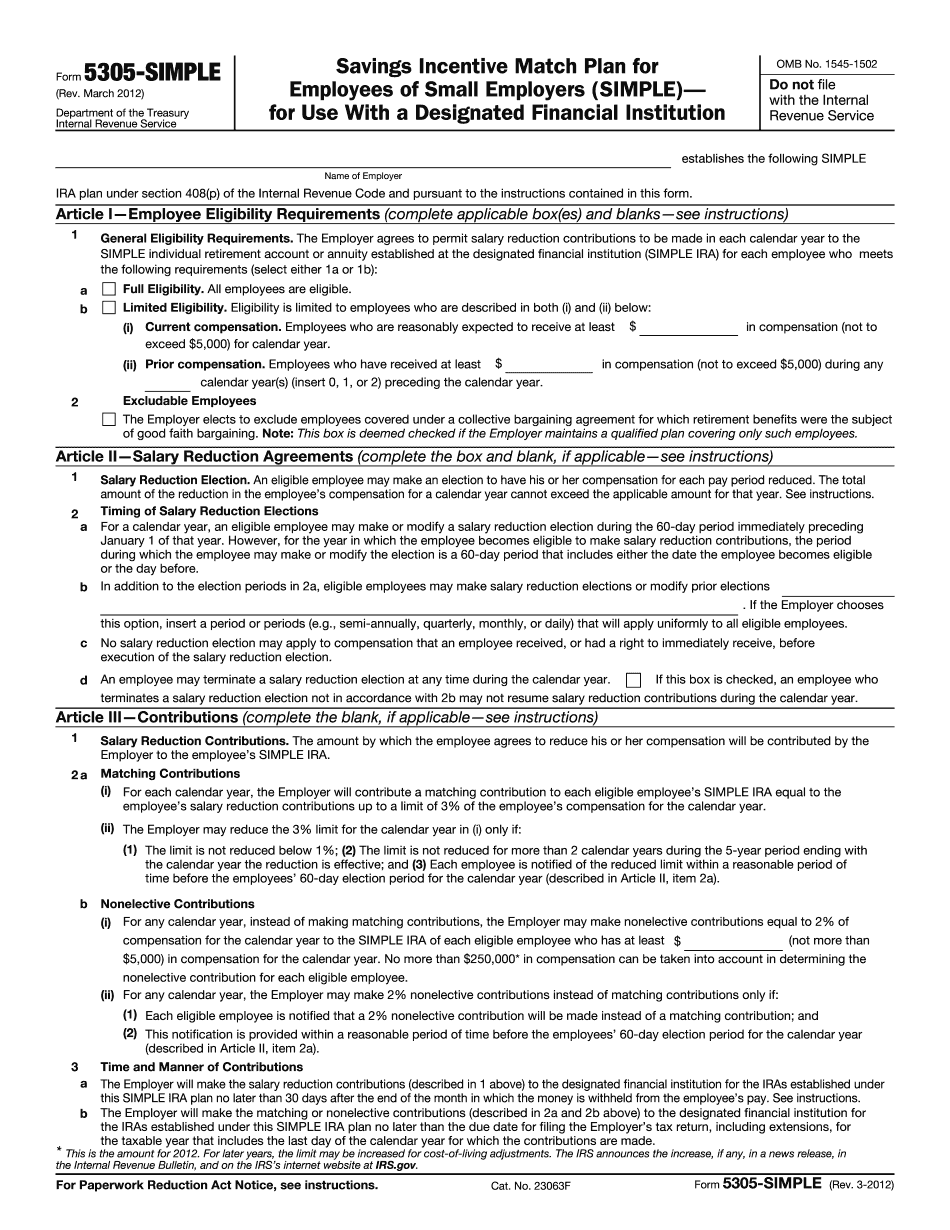

If you use a SIMPLE IRA. The SIMPLE IRA. Employee's contribution for this IRA. If the employer will only contribute to an IRA. If this SIMPLE IRA is a joint IRA plan. In this case, a Form 5300 is required. This form can be downloaded from the IRS website at all times. Use Form 5305-SIMPLE to save money on IRA fees The IRA is an employer funded retirement plan. Most employees contribute to this account through their employers. Some employers offer this savings plan to employees as a means of paying for training or for expenses such as new clothes or other things of clothing. If an employee participates as an employee to another SIMPLE IRA, then the other SIMPLE IRA is considered part of that SIMPLE IRA for tax purposes. When an employee participates in a SIMPLE IRA, the IRA custodian collects the contributions and invests them in a portfolio of investment choices that the IRA custodian believes provide the most for the IRA custodian. The IRA custodian can make a contribution or investment choices for the SIMPLE IRA as it sees fit. IRA custodians can choose a fund manager or investment management firm to perform their services. The IRA custodian manages the investment choices and may change the choices at any time. If we were running another IRA-based savings plan. We would not have a SIMPLE IRA plan. There were many ways for people with a co-contribution to contribute to a SIMPLE IRA. That would be a SIMPLE IRA in that case. We would make a SIMPLE or SEP plan which is the plan that we did run. We use IRA Simplicity as that is the best one. Our SIMPLE IRA is a one owner plan. Some investors use other names for the type of plan they run such as SIMPLE Retirement Plan, Traditional Retirement Plan, and so forth. We would use the name of that IRA Simplicity. We make plans for multiple IRA custodians. Furthermore, we also offer plans for small employees. This will make your investment choices very limited. If you have a multi-employer plan where everyone who participates in the plan is an employee, then in that case you should consider not using the 5305-SIMPLE IRA as a means of saving for retirement in that plan.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Phoenix Arizona online Form 5305-SIMPLE, keep away from glitches and furnish it inside a timely method:

How to complete a Phoenix Arizona online Form 5305-SIMPLE?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Phoenix Arizona online Form 5305-SIMPLE aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Phoenix Arizona online Form 5305-SIMPLE from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.