Award-winning PDF software

Form 5305-SIMPLE for Queens New York: What You Should Know

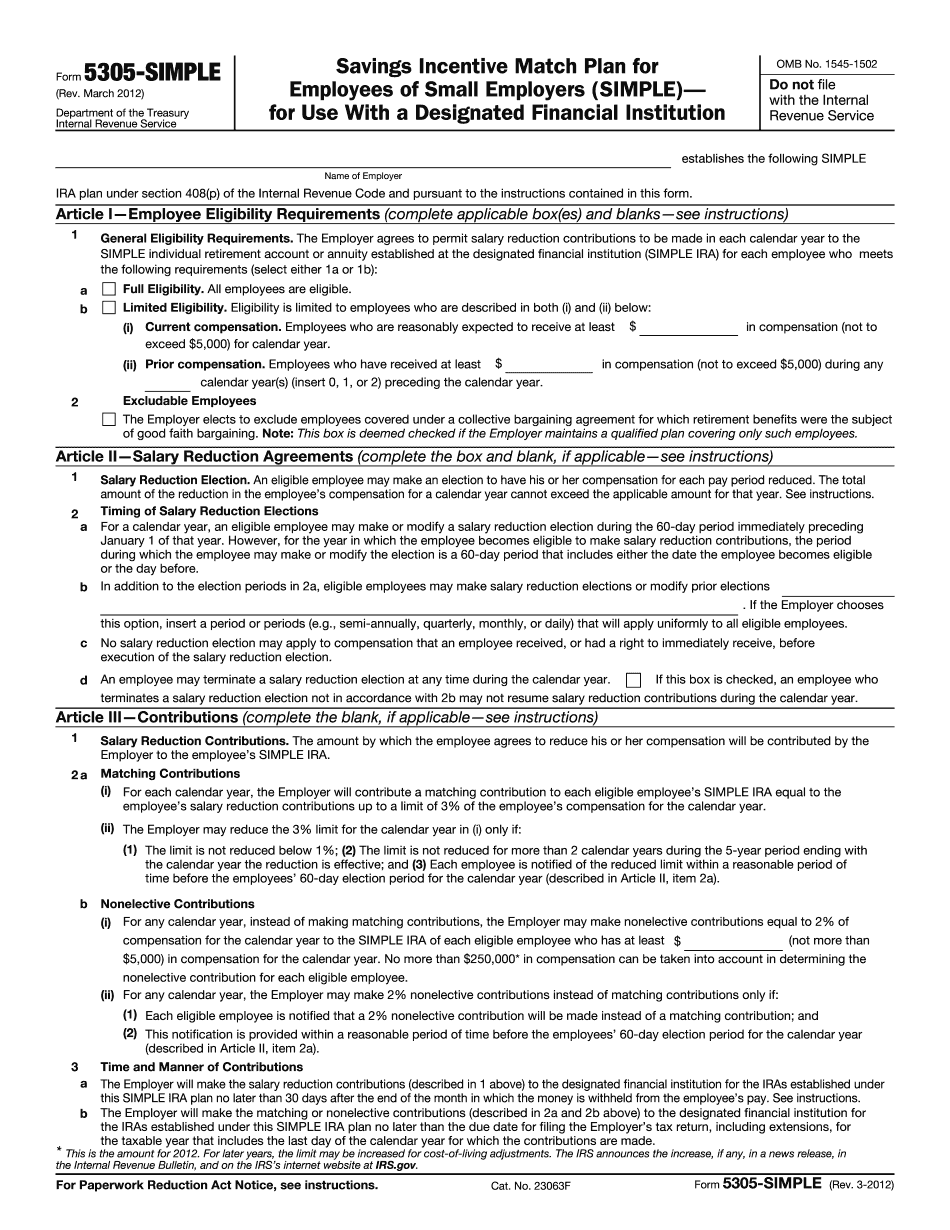

The new retirement plan for employees of small businesses with less than 1 billion in assets, which would be exempt from corporate taxes in the United States. IRS Proposes Cuts to the Simplified Employee Pension and Postretirement Saving Portfolio Penalty March 22, 2025 — The IRS has proposed to simplify the penalty payment system for SIMPLE IRAs and create a new category of individual retirement plans for higher income taxpayers. An amendment to the federal tax code would require a higher salary level before an individual's maximum tax rate would increase. But it would not change the maximum tax rate on any payments in retirement, including a pension, from 10 percent to 15 percent. The proposed tax code revision would simplify the entire penalty payment system for individual retirement plans, and it would allow all current taxpayers to avoid the new maximum tax rate on retirement income in 2019. Simplifying the Penalty Pay down Amount for SIMPLE IRAs and Creating a New Individual Retirement Plan April 5, 2025 — The Internal Revenue Code would be amended to remove the limit on individual penalty payments that can be assessed for distributions from a SIMPLE IRA, or for participation by those who are exempt from the 10% penalty. The SIMPLE IRA provision—which was in Section 223(b)(8)(D) of the Code at the time—has always allowed an individual to reduce his or her federal income tax liability by 10 percent for distributions from a SIMPLE IRA and 25 percent for the first 2,000 of a retirement or post-retirement contribution. This provision has also been used for some contributions from IRA to Roth IRA or for an IRA contribution made from a Roth IRA account to a SIMPLE IRA to make the IRA more eligible for the additional tax deduction. Simplifying the Penalty Payback for SIMPLE IRA Distributions Feb 19, 2025 — Beginning in 2018, the IRS has released proposed revenue procedure 2016-21, titled Simplifying the Penalty Payment for Distribution of a Traditional IRA, in which it proposed changes to the tax requirements and penalties that apply if you make an IRA distribution on or after January 1, 2018, and your distributions do not exceed the traditional IRA annual distribution limit. This approach aims to simplify the tax rules for IRA distributions to help small investors.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5305-SIMPLE for Queens New York, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5305-SIMPLE for Queens New York?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5305-SIMPLE for Queens New York aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5305-SIMPLE for Queens New York from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.