Award-winning PDF software

CO online Form 5305-SIMPLE: What You Should Know

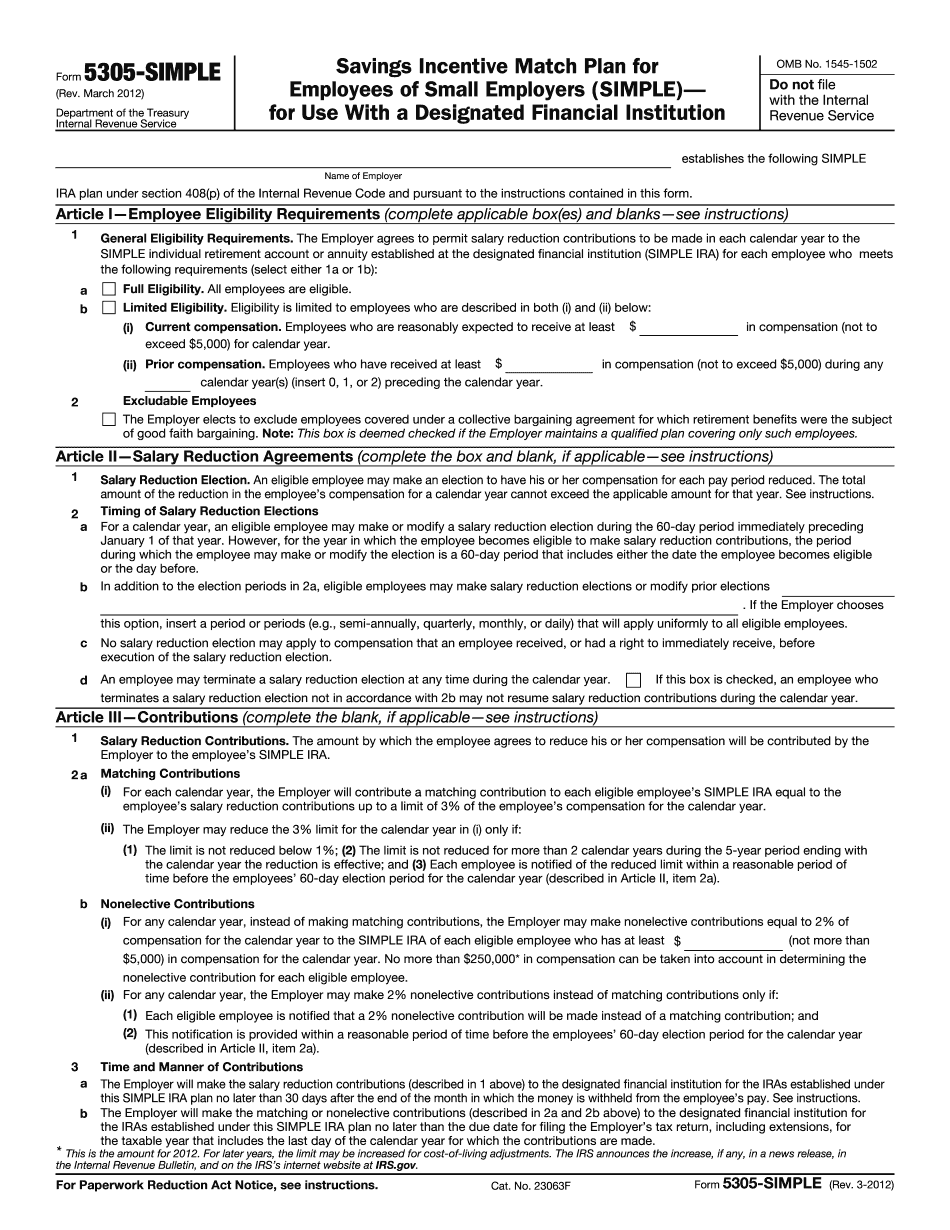

SIMPLE. This may be used to adopt the SIMPLE IRA plan if you already have an approved SIMPLE IRA (Form 5015-SIMPLE) or to provide information for an existing SIMPLE IRA plan. The application form may be requested by emailing If you already have a 5015 or 5304SIMPLE, you can still use Simple IRA Plan Adoption Form (Form 5305-SIMPLE-P) or SIMPLE IRA Plan Adoption form (Form 5305-SIMPLE, Form 5304). The form that you will receive from Vanguard requires that you verify for vacation in this area. For information about filing your own form see the Application Procedure in the Publication 778 for Small Employers and SIMPLE IRAs. The SIMPLE IRA plan is designed as a way for an employer to offer more money to an employee who is better able to pay for his/her own retirement and less likely to draw on funds that would be available to other employees. A SIMPLE IRA plan can include: 401(k) plans. 457 plans. Pension plans. IRA accounts. SIMPLE A annuity (or SIMPLE AS) It is important to know that you must be an employee of an employee owned business (EOB) to qualify for coverage under the SIMPLE IRA plan. To be an employee owned business, an organization must be organized solely for the purpose of providing employment and must be able to demonstrate to the IRS that it is conducting a regular business. You do not need to own a stock, bond, or annuity to qualify if your business is a corporation, limited liability company, partnership, or S corporation. If you are an individual who elects to purchase or sell stock, you may be responsible for your share of taxes paid as an individual shareholder on a stock purchase for a year. When it is used for a SIMPLE IRA plan (or adopted under the SIMPLE IRA plan) by an employee-owned business, the employee-owned entity must maintain a list of current and former employees who contribute or receive SIMPLE IRAs. The employee-owners must update the list annually.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete CO online Form 5305-SIMPLE, keep away from glitches and furnish it inside a timely method:

How to complete a CO online Form 5305-SIMPLE?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your CO online Form 5305-SIMPLE aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your CO online Form 5305-SIMPLE from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.