Award-winning PDF software

Form 5305-SIMPLE online WV: What You Should Know

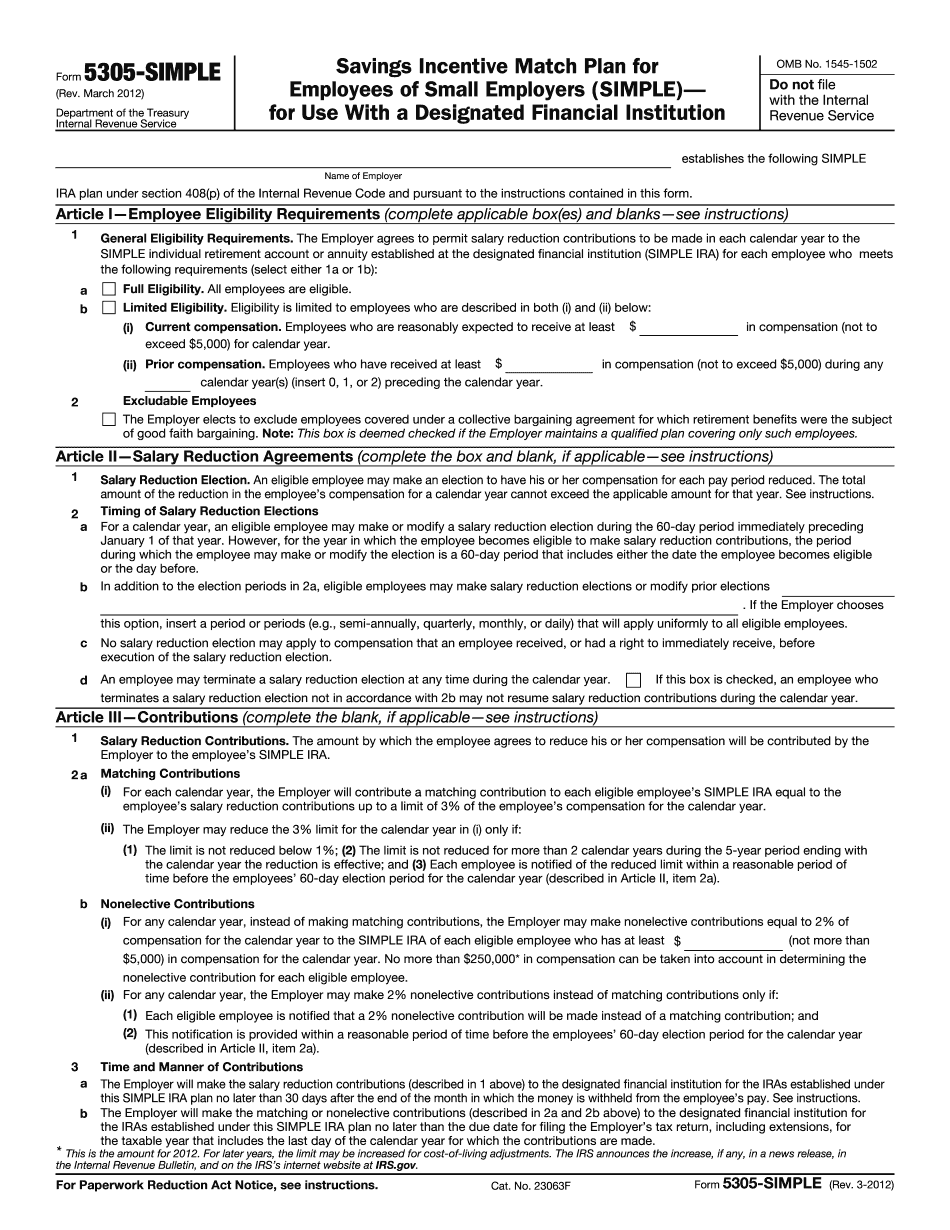

The main difference is that 5305-SIMPLE is tax-deductible for an employer while 5304 is not. With 5304 your employer will still be responsible for the taxes on the benefits you get. The benefits you get with a SIMPLE IRA are only on the contributions you make — there is no tax deferred at the end of the year, in fact you don't get any benefits at all. However, the IRA will grow tax deferred and pay out tax deferred dividends. The only exception to this is the IRS. The IRA provider has the power to choose how much of those taxes you pay, as long as the IRA is used for qualified retirement planning. SIMPLICITY IS REQUIRED An employer can only make contributions to a SIMPLE IRA if they have been provided with the Form 5304-SIMPLE by the employee of the company. An employee cannot contribute through an HSA or a SIMPLE. The IRS has a list of the companies with which the IRS has previously completed Form 5304-SIMPLE for employees. It will say the company is not currently doing it — it has been removed. You will need to ask your employer which IRA they plan do with the amount. Please, do not try to pay a money order to an IRA provider unless it is to use one of their special SIMPLE IRA offerings! The 5304-SIMPLE will be given to you after the paperwork is complete, but the IRA provider will take the money while you wait. Once they have your money to hand, they will ask for your SSN. You will then be asked for your Social Security Number (SSN) and will have to enter it on either the Form 5304-SIMPLE or on the IRS 1040. If you are an individual the SSN is only taken out on Form 1040. If you live in your parent's house, the tax return is filed and the payment is sent out. If you are a company, the payment is made to you with Form 940. The Form 940 will make the payment. If an IRA provider or your employer doesn't have an IRA they can make an IRA with another person as an agent. They do so by transferring all the money from your paycheck or bank account to the IRA with a check from the IRA provider to the agent. You must sign the document which explains exactly how your money will be paid to you (Form 1099.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5305-SIMPLE online WV, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5305-SIMPLE online WV?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5305-SIMPLE online WV aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5305-SIMPLE online WV from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.