Award-winning PDF software

Iowa online Form 5305-SIMPLE: What You Should Know

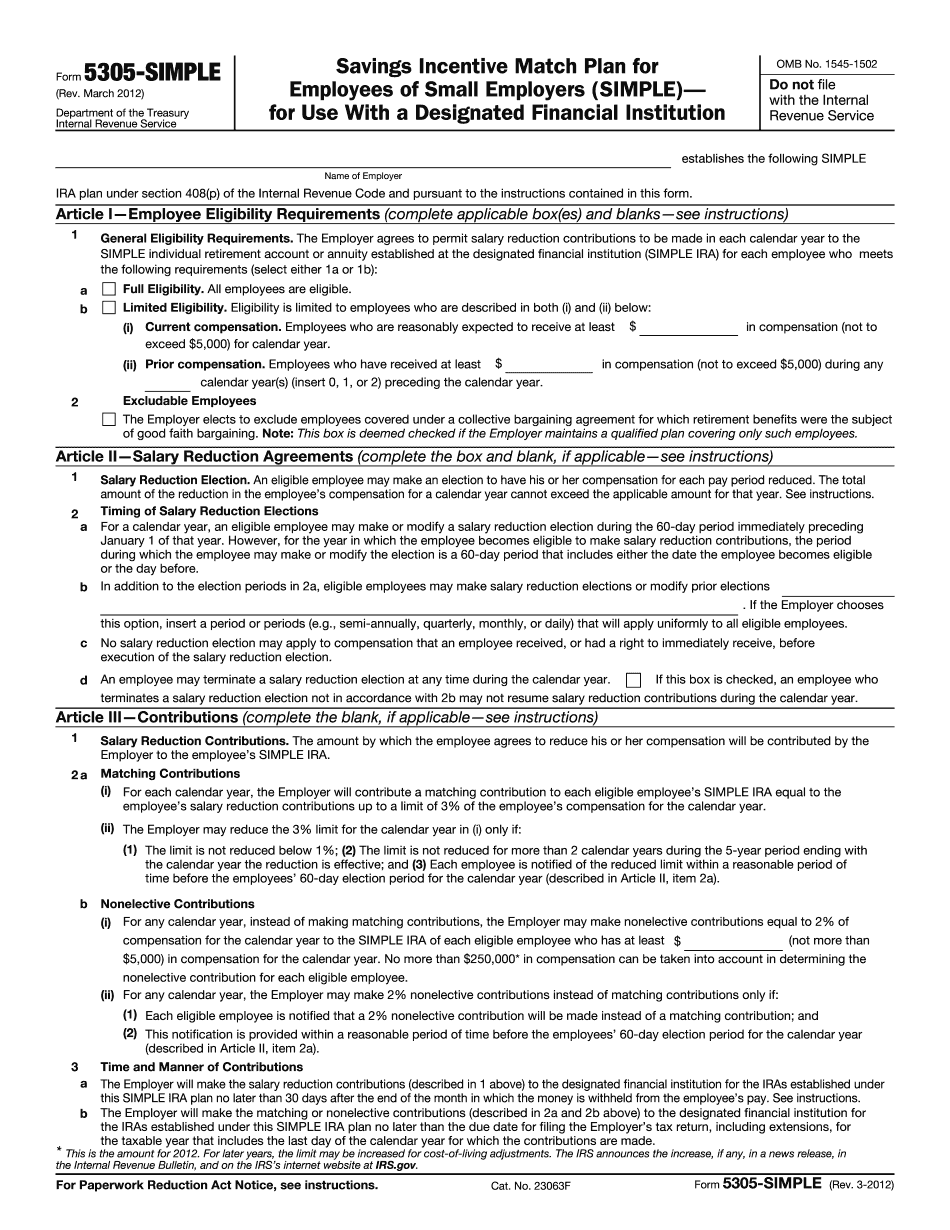

Form 5305. SIMPLE. IRA. Plan document that an employer may use to administer the plan for one employee or a group of employees. The SIMPLE IRA is a type of retirement plan offered by IA State Bank as an option for retirement savings for employees. The IRA is an Individual Retirement Account. You can choose to have your employer contribute to your IRA simplified form 5304-SIMPLE. In your own time and at no cost. You will earn tax-free interest and no management fees for the money you save. The IRS says: Your retirement savings decisions should reflect your own unique goals, financial needs and financial circumstances. In addition, you may wish to consider the following questions and their answers: Q. What retirement financial plans should I consider when choosing an IRA? A. Consider the following when you are making your retirement saving decision: 1. How much tax can I really save with my investment? 2. Should the balance in my retirement savings account be invested in a relatively low cost high risk investment or in a relatively high cost high risk investment 3. Should my investment account be invested through a traditional IRA or a Roth IRA? 4. What type of IRA is best? 5. Will my investment account grow tax-free if I die? 6. How do I invest my retirement savings? Q What should I know about how my retirement savings will grow if I retire when I am old? A. You must take care of your investment account each month because it may be subject to forfeiture. If a withdrawal is made while you are still alive, it may affect the size of your retirement account as it will affect the amount of tax you pay on your withdrawal. There are two ways you can manage your retirement savings account so that the amount you have to pay tax on will be minimal at all times when you are alive: 1. You may open a SEP IRA or a Traditional IRA. You can open either or both as part of your account at your retirement planning firm, or you can choose from their online portfolios if you just want to do it once. Furthermore, you will pay no additional taxes when withdrawing the money while you are alive. 2. Furthermore, you may get a company provided retirement account (sometimes referred to as a 401(k) or 403(b) plan or an IRA). Furthermore, you will not have to pay taxes when withdrawing all the money you have invested in an IRA.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Iowa online Form 5305-SIMPLE, keep away from glitches and furnish it inside a timely method:

How to complete a Iowa online Form 5305-SIMPLE?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Iowa online Form 5305-SIMPLE aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Iowa online Form 5305-SIMPLE from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.