Award-winning PDF software

Albuquerque New Mexico online Form 5305-SIMPLE: What You Should Know

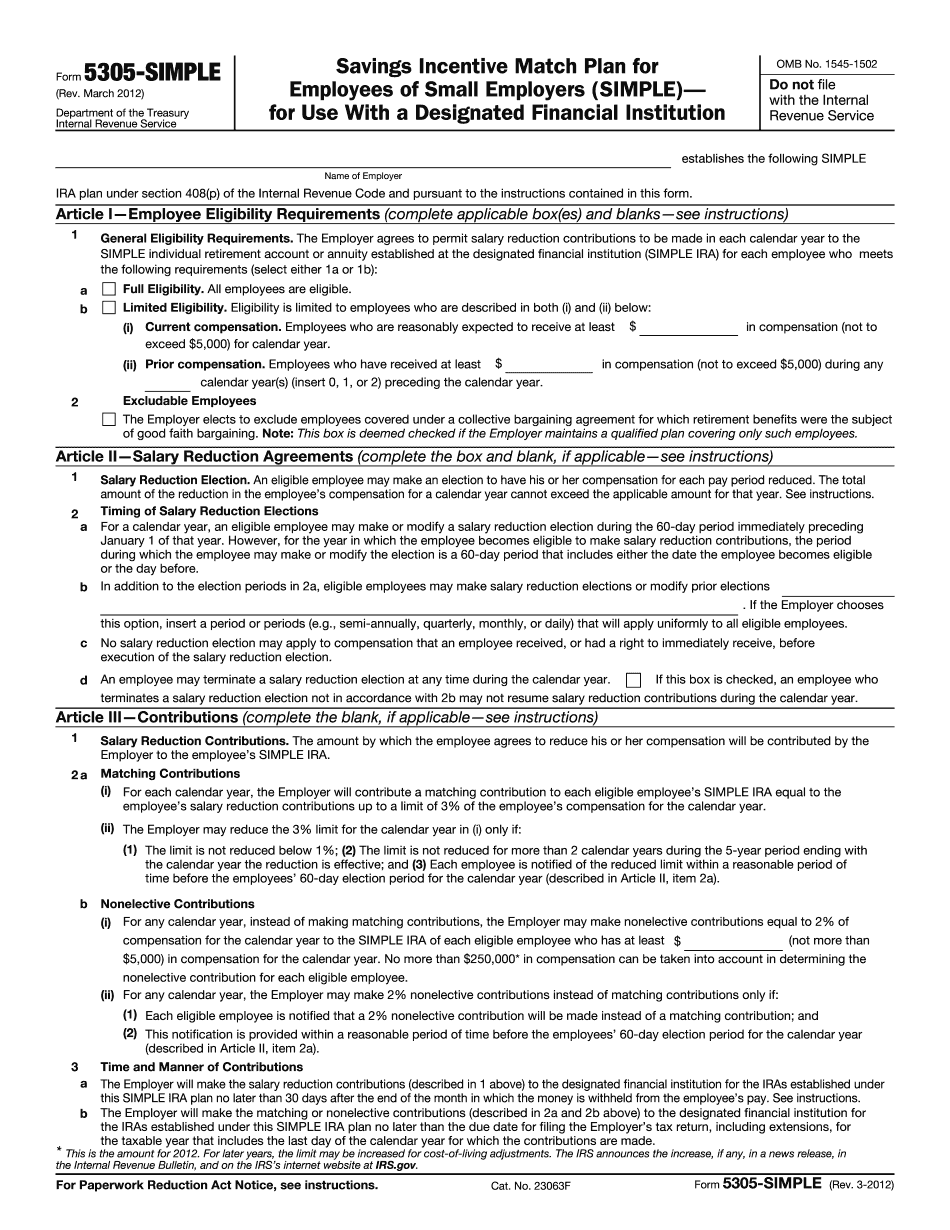

For example, your employees might contribute a portion of their take-home pay to their accounts each pay period, or your organization might contribute through a 401(k) plan or an IRA. The arrangement is in place to protect you from the financial consequences of an unfunded employee benefit plan, which are financial issues that often cannot be addressed by other means. When a plan is funded, the benefits earned on such contributions are distributed to qualified participants at the end of the plan's operating period, defined as the life of the individual or the life expectancy of the participant, whichever is longer. The amount of contributions into a SEP can be up to 80% of salary, no matter how much the employee contributes to the SEP. For example, if a custodian who is paid an annual salary of 100,000 makes only 30,000 in qualified distributions, all the qualified distributions would count toward the 80% limitation, but only 50,000 of the contributions would count toward the limit. Thus, the employee would qualify for only 60,000 in required IRA contribution (and only 27,000 in optional Roth contribution) before he or she could access the additional 50,000 in after-tax contributions. If the custodian instead took home at least 40,000 in qualified distributions for the year, he or she would qualify for at least 40,000 of after-tax contributions. IRA custodians can qualify as SEPs if they manage employee pensions as an agent of the employer. In addition to providing you with a way to provide your employees with more flexibility, SEPs help keep your financial books simpler when it comes to reporting retirement plan contributions and withdrawals (as defined in section 223(f)). Employer-owned IRA custodians need to be self-directed SEP custodians as defined in IRM 5305.26. For more information, go to: IRA Self-Directed Custodial Account. Specialized Trust Company (STC). For information on SEPs and self-directed SEP IRAs, go here. The I.R.C. and the I.R.C. § § § 5305(a) and 5305(b) are the primary sources of information for determining IRAs for self-directed self-employed account holders (SDA), as defined in IRM 5305 and its regulations, except for tax years for which the ITA is not available.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Albuquerque New Mexico online Form 5305-SIMPLE, keep away from glitches and furnish it inside a timely method:

How to complete a Albuquerque New Mexico online Form 5305-SIMPLE?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Albuquerque New Mexico online Form 5305-SIMPLE aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Albuquerque New Mexico online Form 5305-SIMPLE from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.