Award-winning PDF software

Fontana California online Form 5305-SIMPLE: What You Should Know

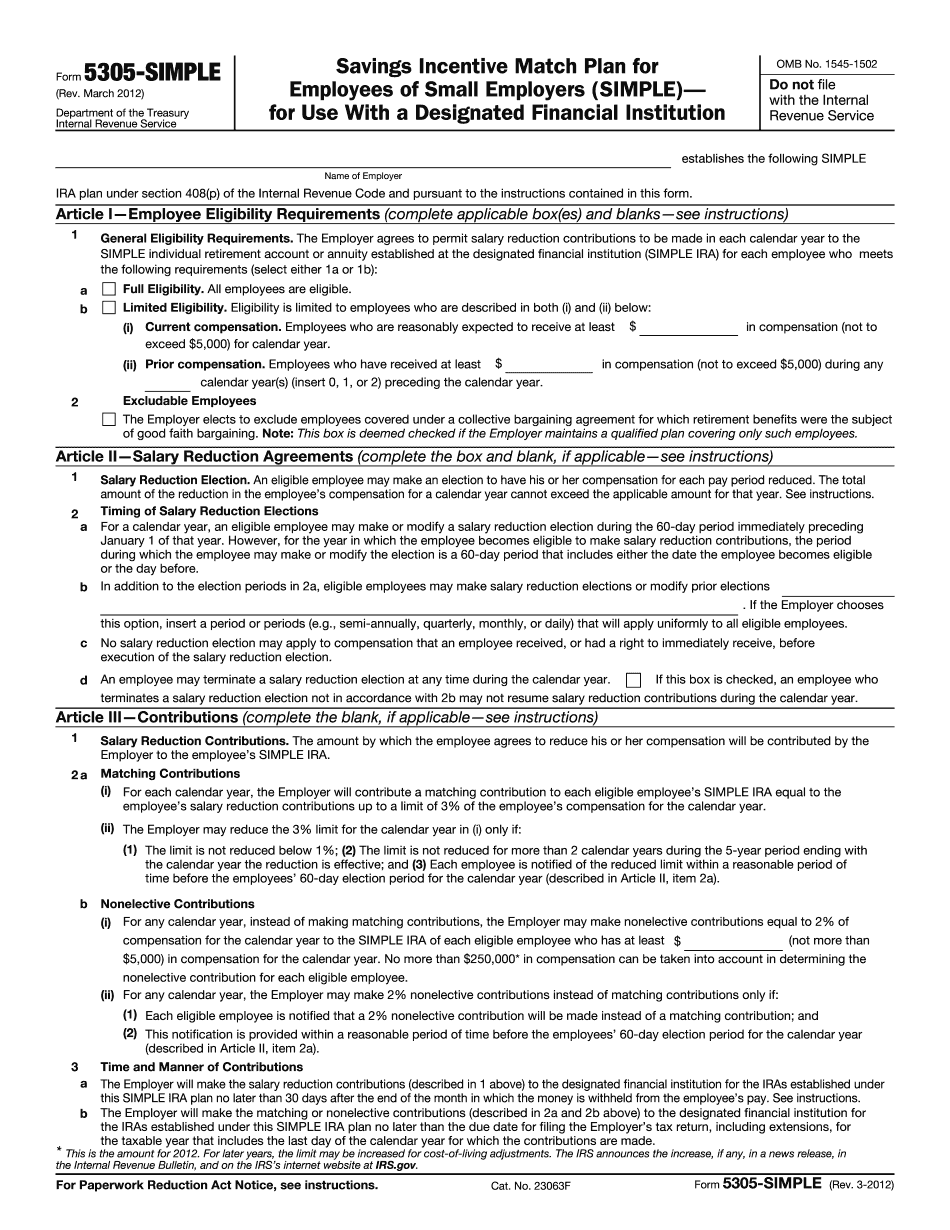

Fontana California — Official Website You can use this form to claim any form of salary reduction or benefit payments to which you are entitled based upon the circumstances. The information contained in this form must be in the same format as if you were submitting a claim for tax year of the tax year in which the payment is made. In other words, the information in this form could be used, but it must be submitted in the format of a tax return for the year of the payment rather than the payment year. In most cases, an employee's payment of benefits should be reported as Form W-2. An employee who makes an employer-provided payment of benefits (tax-free) to an independent contractor shall report such payment as employment income only on forms and schedules prescribed by the Internal Revenue Service. There are two types of SIMPLE plans available. The original SIMPLE Plan was approved July 26, 2004. The new SIMPLE Plan was announced in a series of press releases issued in 2005, and is the current version of the plan. This document is meant to provide an explanation or general overview of the SIMPLE Plan. The actual plan may be subject to change or discontinuation by the City Council. Please refer to the specific terms of the SIMPLE Plan for details on eligibility. The City of Fontana is in the process of revising this document to comply with section 2037 of the Internal Revenue Code. This document is intended to provide guidance to employees and their representatives regarding all aspects of the City's SIMPLE Plan. It specifically applies to employees who are eligible or not eligible for the SIMPLE Plan, are employees of the City, and are under the general supervision and control of the City. It does not limit the employee's use of the SIMPLE Plan benefits, nor does it prevent the employee from withdrawing or converting his/her SIMPLE plan benefits to another plan. SIMPLE benefits paid on the basis of performance will be treated as earned. For example, an employee who is designated a certain amount as her “performance payment” may not receive “bonus payment” benefits if the performance is not met. Also, a SIMPLE plan benefit paid for a particular service may be transferred to another “service” if such a transfer is permissible under the rules of the plan. SIMPLE plan funds are subject to the provisions of Title I of the Internal Revenue Code (as amended).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Fontana California online Form 5305-SIMPLE, keep away from glitches and furnish it inside a timely method:

How to complete a Fontana California online Form 5305-SIMPLE?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Fontana California online Form 5305-SIMPLE aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Fontana California online Form 5305-SIMPLE from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.